When determining the interest rate for loans entered into between related entities, it is essential to verify whether the rate specified in the loan agreement is in line with market conditions at the time the financial transaction is concluded. The arm’s length nature of the interest rate should be assessed considering all terms of the transaction and whether the agreed rate does not exceed the maximum allowable interest rate.

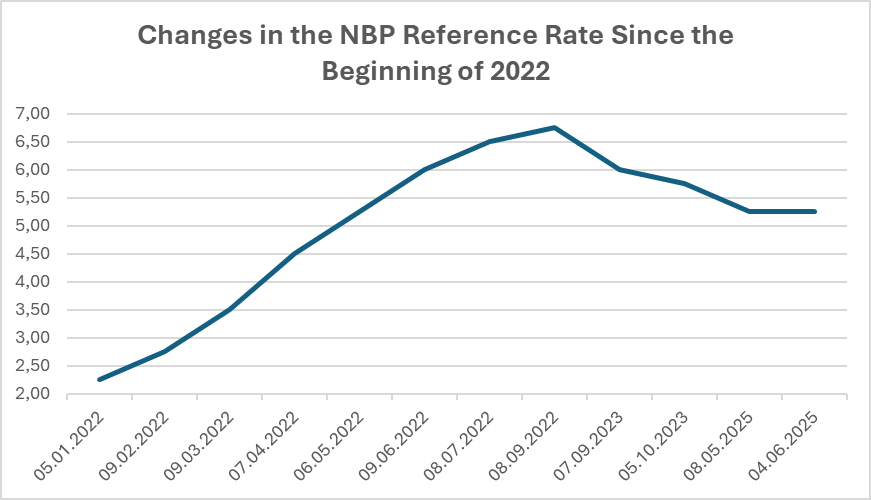

On Wednesday, June 4, 2025, the Monetary Policy Council (RPP) concluded its two-day meeting. As expected, the Council decided to keep the National Bank of Poland’s (NBP) interest rates unchanged—the reference rate remains at 5.25%. The June statement, aside from updated domestic and international macroeconomic data, does not differ significantly from the May release, which had provided the rationale for the earlier 50 basis point rate cut. Some economists suggest that there is still room for further reductions in the NBP reference rate in 2025. According to experts, there is a possibility that the RPP will reduce rates by 25 basis points by July, with additional cuts potentially occurring in September and November. This could bring the reference rate down to 4.50% by the end of 2025. The ongoing downward trend—from 6.75% on September 7, 2023, to the current 5.25%—represents a slow but promising shift toward a monetary easing cycle.

Each increase in the NBP reference rate alters the maximum allowable interest rate as defined in Article 359 of the Civil Code and thus has implications for the maximum interest rate applicable to loans.

The changes in the maximum interest rate in recent years are presented in the table below:

| Effective from: | NBP Reference Rate (annual %) | Maximum Interest Rate (annual %) |

| 05.01.2022 | 2,25 | 11,5 |

| 09.02.2022 | 2,75 | 12,5 |

| 09.03.2022 | 3,5 | 14 |

| 07.04.2022 | 4,5 | 16 |

| 06.05.2022 | 5,25 | 17,5 |

| 09.06.2022 | 6 | 19 |

| 08.07.2022 | 6,5 | 20 |

| 08.09.2022 | 6,75 | 20,5 |

| 07.09.2023 | 6 | 19 |

| 05.10.2023 | 5,75 | 18,5 |

| 08.05.2025 | 5,25 | 17,5 |

| 04.06.2025 | 5,25 | 17,5 |

Regardless of the nature of changes in the market environment, a reduction in interest rates affects the level of financing terms that parties to a financial transaction would be willing to agree upon. As a result, related parties engaged in financial transactions must monitor whether the terms set out in the agreement continue to reflect arm’s length conditions—i.e., those under which unrelated parties would also be willing to enter into a comparable transaction.

What actions should be taken to avoid challenges to the terms of financial transactions?

For agreements concluded in the past:

If a comparative analysis has been prepared for a given financial transaction, it is necessary to verify whether it remains up to date. According to the Corporate Income Tax Act, such a benchmarking analysis must be updated at least once every three years, unless changes in the economic environment have significantly affected the analysis and justify an earlier update.

For agreements with variable interest rates, where:

- the comparative analysis has not been updated in the last three years, or

- the current interest rate falls outside the range presented in the analysis,

it is recommended to update the benchmarking study using the latest market data.

For agreements with fixed interest rates, if the benchmarking analysis has not been updated within the last three years, we also recommend updating the analysis using current market data.

For agreements currently being concluded:

A taxpayer planning to enter into a financial transaction must verify whether, at the time of signing the agreement, the interest rate specified in the contract:

- does not exceed the maximum interest rate applicable on the date the loan agreement is concluded;

- is at arm’s length in the context of the overall loan terms, meaning that unrelated parties would agree to similar conditions.

Note: Compliance with the maximum interest rate does not automatically mean that the interest rate is at arm’s length—this should always be separately analyzed.

Transfer Pricing Policy

Taxpayers who wish to be prepared for market changes in their business environment may choose to develop their own transfer pricing policy. This is a document outlining the practices adopted by the company or the entire capital group in the area of transfer pricing. A transfer pricing policy serves as a framework for managing key aspects of related-party transactions, such as:

- the valuation of transactions with related entities,

- the method for documenting transactions—including transfer pricing documentation templates,

- procedures for collecting source documents and information necessary for transaction documentation,

- designation of the person responsible for managing transfer pricing risk within the company,

- the process for preparing transfer pricing documentation and fulfilling other related obligations,

methods for setting prices, repayment terms for financing, and assessing the impact of interest rate changes on transactions between related parties.