Robotics relief

Check whether you can deduct additional business costs

Robotics relief

The Robotics relief is an initiative proposed by the Ministry of Development and the Ministry of Finance aimed at supporting the growth of an innovative economy. It is modeled on the Research and Development (R&D) tax relief, which has been in place since 2016.

The core objective of the robotics relief is to allow entrepreneurs to deduct 50% of eligible costs incurred in relation to robotization, regardless of the size or type of industry. This relief is available to both Personal Income Tax (PIT) and Corporate Income Tax (CIT) taxpayers. However, it is important to note that in the event of a tax audit, taxpayers must be able to demonstrate compliance with the conditions required to benefit from the relief.

What expenses are deductible?

The relief is intended to encourage the widest possible range of taxpayers to invest in robotization. Deductible under the robotics relief are the costs associated with the acquisition and implementation of industrial robots, as well as related equipment, software, training, and services necessary for their deployment and integration.

How much can be saved thanks to the robotics relief?

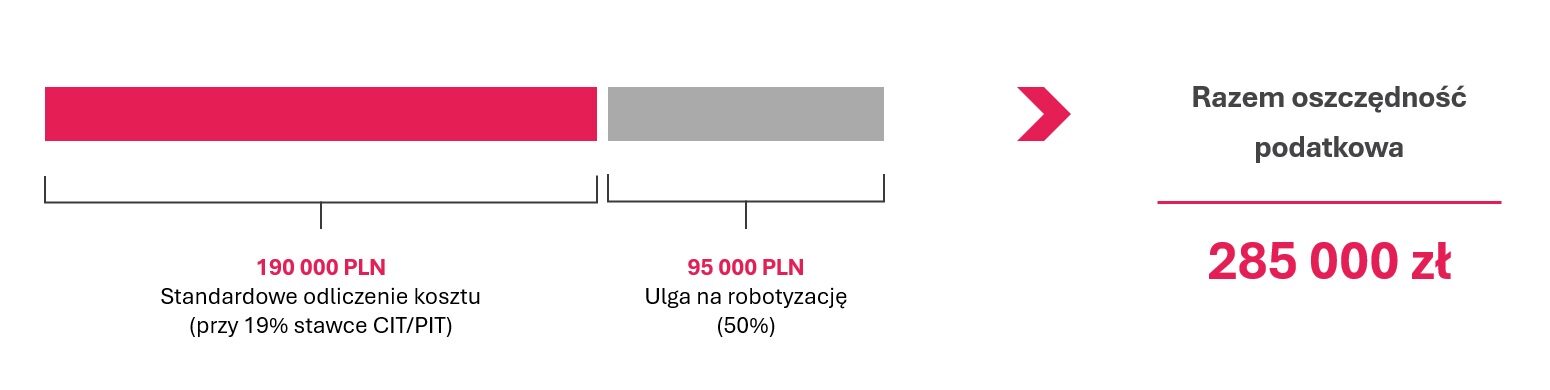

The relief enables taxpayers to deduct a total of 150% of incurred expenses for income tax purposes, broken down as follows:

- 100% as a tax-deductible business expense;

- 50% as an additional deduction under the relief.

For an investment worth PLN 1 million, the robotics relief allows for a total income tax deduction of PLN 285,000.

FAQ

The robotics relief was introduced in Poland on January 1, 2022. It allows for the deduction of robotization-related expenses incurred between 2022 and 2026.

The relief will be available until the end of 2026.

The robotics relief, like the Research and Development (R&D) relief, is a cost-based relief. This means that the taxpayer can deduct robotization-related expenses during the tax year, and provide an additional description at the time of filing the annual tax return.