Important dates in 2023 - for companies with a fiscal year coinciding with the calendar year.

| 31.03.2023 r. | Deadline for preparing the Master File for 2021;Submission of CIT-8 (transfer pricing adjustment information);Submission of ORD-U (be aware of possible exemptions);Submission of CBC-P (for 2022). |

| 31.10.2023 r. | Deadline for preparing the Local File and benchmark and compliance analyses. |

| 31.11.2023 r. | Deadline for submitting TPR form (with a market-price clause - no need to submit a statement as in previous years). |

| 31.12.2023 r. | Deadline for preparing the Master File and submission of CBC-R for 2022. |

New documentation and reporting deadlines

Deadline for preparing the Local File -- by the end of the 10th month following the end of the fiscal year.

Deadline for preparing and submitting transfer pricing information (TPR form) - by the end of the 11th month following the end of fiscal year.

Deadline for submitting the Local File by the taxpayer at the request of the tax authority - 14 days.

Changes in transfer pricing for 2023

Important: These changes concern transfer pricing documentation for 2022.

- The taxpayer is required to submit the TPR form to the relevant Head of the Tax Office, not to the Head of KAS as before.

- No obligation to submit a statement on the preparation of transfer pricing documentation nor on the market-price clause - this year it will be merged with the TPR form (previously it was a separate document).

- The TPR form with a market-price clause should be signed (in the case of companies) by the head of the entity, and in case the entity is headed by several members, by a distinguished person who is part of the management body. Important: It is not permissible to sign this information through a proxy, except for a proxy who is a lawyer, legal adviser, tax advisor or statutory auditor.

- No obligation of submitting an ORD-U for taxpayers/non-corporate companies that are required to submit TPR and do not carry out transactions with tax havens.

- The rules for reporting direct transactions with tax havens have changed. Increased thresholds:

- PLN 2,500,000 – in the case of a financial transaction;

- PLN 500,000 – in the case of a transaction other than a financial transaction.

- The possibility of not preparing a benchmark and compliance analyses:

- controlled transactions concluded by taxpayers who are micro or small enterprises;

- transactions other than controlled transactions concluded with the tax havens covered by the obligatory documentation.

- The catalogue of exemptions from the obligation to prepare local file documentation has been expanded for:

- controlled transactions covered by the investment agreement and the tax agreement;

- transactions on settlements for “pure reinvoicing” (under specific conditions);

- controlled transactions covered by the safe harbour mechanism for low value added services (under fulfillment of conditions in art. 11f);

- controlled transactions covered by the safe harbour mechanism for loans, credits, bonds (under fulfillment of conditions in art. 11g).

It should be remembered that the tax authority has the right to examine the market value of transactions between related parties regardless of the question of whether the obligation to prepare transfer pricing documentation arises.

In the next article, we will describe the changes regarding transfer pricing adjustments and sanctions related to a failure to prepare transfer pricing documentation. We encourage you to follow our Linkedin profile.

As a result, all EU member states will undertake implementing regulations complaint with the proposed global minimum corporate tax on large multinational enterprises by the end of 2023.

This solution, part of the reform of international corporate tax rules, is known as Pillar 2 of the Organization for Economic Cooperation and Development (OECD) reform of international taxation.

Global minimum corporate tax assumptions

The global minimum corporate tax may be interpreted as an answer to the negative repercussions stemming from a globalized and digitalized economy – so-called aggressive tax planning and the ensuing avoidance of tax. Favorable tax jurisdictions have made it easier than ever for large multinational companies to shift profits to countries offering the lowest corporate tax. The minimum global corporate tax, a project backed by 136 countries, aims to resolve this issue by taxing profits which are currently taxed below the minimum rate of 15%.

The “COUNCIL DIRECTIVE on ensuring a global minimum level of taxation for multinational enterprise groups and large-scale domestic groups in the Union” stipulates a global minimum corporate tax of 15% per country, in line with the proposal set forth by the OECD. Since the minimum tax level must be examined separately per country, company groups whose global tax burden reaches or exceeds 15% may face additional payments.

Which companies fall under the scope of the new regulations?

Unquestionably, big tech companies, the major beneficiaries of tax havens, will be hit the hardest. The directive covers all corporate multinational groups, both foreign and domestic, with a combined annual turnover of at least €750 million.

An innovative approach?

The global minimum corporate tax is indeed a very innovative proposal. Without doubt, the implementation of such a tax will present a myriad of benefits to developing countries struggling with tax collection via traditional means. These countries indicate a reliance on corporate tax to carry out planned public policy goals. However, favorable taxation was a major incentive and driving force for direct foreign investment.

Any doubts?

Many countries will be in the position of introducing new incentives to attract business. Another question arises. Will these incentives ensure compliance with the new global tax regulations? All that remains is to wait for further advances in this matter.

As of April 1st, 2023, the employer is obliged to make PPK contributions for all people who have previously submitted a declaration of opting out of PPK contributions, unless an employee again opts out of contributing to PPK (the person must submit a declaration of opting-out to their employing entity).

Employers, to fully implement the PPK program in their company, are required to sign two documents with the PPK Institution:

- PPK management agreement with the financial institution;

- Contract for running PPK with employees and contractors.

Employers, with whom all employees previously submitted a declaration to opt-out of PPK, may have not concluded the second agreement - on the creation of PPK. In this case, the Employer should, in the first half of March 2023, conclude an agreement on having PPK with the PPK Institution.

The “auto-enrollment” date is the same for all employing entities, regardless of when they decided to implement the PPK program in their company.

By 28.02.2023

The employer is required to inform all their employees who decided to discontinue making further salary contributions to the PPK program about the program’s “auto-enrollment.”

- “Auto-enrollment” applies to all employees who submitted a resignation from making contributions prior to having a contract on participating in PPK signed on their behalf;

- Information about automatic re-enrollment should also be delivered to PPK participants who submitted a declaration of opting out of PPK contributions while already saving through PPK.

Important: Consecutive notifications will have to be sent every 4 years, i.e. by the end of February 2027, by the end of February 2031, etc.

Exception:

The employer’s obligation of informing employees does not included people who submitted a resignation of continuing PPK contributions and will be 70 years old by the 1st of April. The employer, in considering the situation of such an employee, may deliver information concerning the employee’s entitlements concerning saving through PPK.

The PPK Act does not specify how exactly an employer should fulfill their obligation of informing employees. However, it should be noted that an employer should do it in such a way as to prove, in case of a dispute, that the obligation imposed by the PPK Act has been fulfilled.

Important: Informing employees about the “auto-enrollment” well ahead of the deadline will not constitute a fulfillment of obligations as specified in art. 23(1) in the PPK Act.

The employer has an obligation to inform their employees about “auto-enrollment” by the end of February 2023. Providing this information well ahead of this date will be an acceptable form of educational measures, but it will not be considered as the fulfillment of the obligation to inform.

What does “auto-enrollment” mean and who does it concern:

An employer does not have to obtain an employee’s consent to enroll them in the PPK program. This means that when an employee does not submit a declaration about opting out of PPK contributions, he/she will be automatically enrolled in the PPK program. An employee may later opt out of PPK participation - participation in PPK is completely voluntary for the employee.

Automatic enrollment only concerns people who are between 18 and 55 years of age.

Example: An employee who was 30 years old was not a participant of PPK because he managed to submit a declaration to opt out of PPK prior to the date of enrollment. If the employee didn’t later submit a declaration to participate in PPK, the employer will inform him on February 2023, that these contributions will be made on his behalf starting from the 1st of April. For this to be possible, the employer will have to sign a contract on PPK participation on the employee’s behalf - unless the employee again submits a declaration of not making PPK contributions.

Employees 55+:

People who are over 55 but under 70 years old, and want to participate in the PPK program, must apply to their employer on signing a contract to participate in PPK on their behalf. After receiving the application on signing a contract to participate in PPK or making PPK contributions, the employer will be obliged to implement these requests. This will be concluded not within the “auto-enrollment,” but on general rules. The employee will make PPK contributions on behalf of these employees on the date depending on when the appropriate application was submitted.

Who may not be enrolled in PPK:

People who are over 70 years old may not be enrolled in PPK.

Declaration on resigning from making PPK contributions:

After the 1st of March 2023, employees between 18 and 55 years of age may submit a declaration on resigning from making PPK contributions.

- The declaration of resigning from making PPK contributions requires a written or qualified electronic signature.

The declaration on resigning from PPK contributions becomes valid from the moment of its submission. This means that when this declaration is submitted, the employer may not make any PPK contributions.

Example: a PPK participant submitted a declaration of resigning from making contributions in August 2021. This declaration will be valid until the end of February 2023. By the end of February, the employer should inform this participant about the automatic re-enrollment and resuming of contributions starting from April 1st, 2023. If the employee, after receiving this information, again resigns from making contributions to PPK by issuing the appropriate declaration, these contributions will not be made. The next re-enrollment to PPK will occur on the 1st of April 2027.

- The declaration on opting out of PPK contributions may be revoked at any time by applying for PPK enrollment to the employer.

When does the employer make contributions to PPK:

Contributions to PPK are made starting from the month following the month when the employee applied for PPK participation. These contributions should be calculated and collected in the month when the application was submitted and paid in the following month.

In case an employee, on behalf of whom an employer has not signed a contract on PPK participation due to them submitting a declaration on opting out of PPK contributions, applies for making PPK contributions and has the required period of employment, the employer should sign a contract on PPK participation immediately upon receiving such a request.

Court of Justice judgment

The Court of Justice held that in such transactions, the final customer is not effectively designated as the person liable to pay VAT if the invoice issued by the intermediary acquirer does not contain the indication “reverse charge.”

Failure to include in the invoice the notation “reverse charge” required under the VAT Directive cannot be corrected at a later date by adding information indicating that the invoice involves an intra-Community triangular transaction and the tax obligation is shifted to the customer.

Important

The restrictive approach applied by the Court of Justice, and earlier adopted in the advocate-general’s opinion of 14 July 2022, may generate lots of problems for entities carrying out transactions of this type.

Particular attention must be devoted to whether all of the conditions for applying the simplification for triangular transactions have been fulfilled, and whether the wording of the document, specifically the invoice, is properly stated, to avoid negative financial consequences later on.

This judgment thus confirms that chain transactions need to treated with special caution, not only with respect to the place of taxation of specific supplies, but also in terms of the formal correctness.

VAT regulations on use of the simplified procedure for intra-Community transactions

Under Polish law, an intra-Community triangular transaction is a transaction in which all of the conditions set forth in Art. 135–138 of the VAT Act are fulfilled, namely:

- The transaction involves three VAT payers identified for purposes of the intra-Community transaction in three different member states

- The goods are transported directly from the first VAT payer in the chain of supplies to the last VAT payer in the chain

- The supply of goods is made between the first and the second taxpayers, and between the second and third taxpayers

- The subject of the supply is dispatched or transported by or on behalf of the first or second VAT payer

- Transport of the goods is made from the territory of one member state to the territory of another member state.

This transaction may be settled under the traditional rules, or applying the simplified procedure described in the VAT Act. However, application of the general rules would impose too large a burden on the second entity in the chain of supplies. That entity would have to register in the country to which the goods are transported, recognize an intra-Community acquisition of goods there, and then recognize a local sale.

The simplified method of settling a triangular transaction is designed to relieve the second taxpayer in the chain of these formal obligations. The supply from the second taxpayer in the chain to the last taxpayer in the chain is subject to a self-charge (“reverse charge”) of the tax by the acquirer, who treats it as an intra-Community acquisition of goods. The last entity in the chain thus assumes the obligation to pay VAT from the second entity, which does not have to register for VAT in the country of the final customer or tax the supply and acquisition of the goods there.

Through use of this procedure, it can be deemed that the intra-Community acquisition of goods has been taxed in the country where the shipment of the goods was completed, which relieves the second participant in the transaction from the obligation to tax the intra-Community acquisition of goods in the country that assigned it an EU VAT number (VAT Act Art. 25(2)(2)).

Conditions for applying the procedure

However, application of the simplified procedure in an intra-Community triangular transaction is possible only upon fulfilment of the conditions set forth in VAT Act Art. 135(1)(4):

- The supply to the last taxpayer in the chain was directly preceded by an intra-Community acquisition of goods on the part of the second taxpayer in the chain

- The second taxpayer in the chain, making the supply to the last taxpayer in the chain, does not have an establishment in the territory of the member state in which the transport or dispatch is completed

- The second taxpayer in the chain applies with respect to the first and third taxpayers in the chain the same VAT identification number which was issued to it by a member state other than the member state in which the transport or dispatch begins or ends

- The last taxpayer in the chain applies the VAT identification number of the member state in which the transport or dispatch ends

- The last taxpayer in the chain was designated by the second taxpayer as liable for payment of VAT on the supply of goods carried out under the simplified procedure.

Based on the judgment of the Court of Justice of 8 December 2022, an additional condition for applying the simplified procedure is proper documentation of the transaction, i.e., issuance of a correct invoice as well as preparing a VAT SAF-T (JPK_VAT) with the declaration and summary information.

Formal conditions that must be met by each entity participating in a triangular transaction where the simplified procedure is applied

First VAT payer in the chain

The VAT payer first in the chain recognizes a classic transaction of intra-Community supply of goods to the second entity in the chain. Thus the first taxpayer issues an invoice to the second taxpayer, in which it reports an intra-Community supply of goods transaction taxed at the 0% rate, upon fulfilment of the conditions set forth in VAT Act Art. 42. This transaction is reported in the VAT SAF-T (JPK_VAT) filed with the tax authority along with the declaration (field K_21) and in the EU VAT summary information. The first entity in the chain has no obligation to make any additional designations and bears no additional documentary duties.

Second VAT payer in the chain

In the case of the second VAT payer participating in the transaction, the intra-Community acquisition of goods is deemed to be taxed if the second entity issues to the third and final VAT payer an invoice containing, apart from the data referred to in VAT Act Art. 106e, also the following elements (VAT Act Art. 136):

- Notation “VAT: Simplified Community invoice under VAT Act Art. 135–138” or “VAT: Simplified Community invoice under Art. 141 of Directive 2006/112/EC”

- Statement that tax on the supply will be settled by the last VAT payer in the chain

- The EU VAT number applied by it in relation to the first and last taxpayers in the chain

- The VAT identification number of the last taxpayer in the chain.

In light of the Court of Justice ruling discussed above, the invoice should include the notation “reverse charge” (or the Polish odwrotne obciążenie).

Apart from the data set forth in VAT Act Art. 109(3), the second entity in the chain is required to show in its records the fee established for the supply within the simplified procedure as well as the name and address of the last taxpayer in the chain. This transaction must also be declared in the VAT SAF-T register (JPK_VAT) with the declaration. It will show the basis for taxation for intra-Community acquisition of goods from the first entity in the chain (field K_23), while it should indicate “0” in field K_24 because VAT on the transaction will be settled by the last entity in the chain.

In the recordkeeping portion of the VAT SAF-T (JPK_VAT) it should use the designation “TT_WNT.” It should be borne in mind that this transaction is not shown on the side of input VAT, as would be the case in other transactions subject to the reverse-charge mechanism. To report the supply outside the country to the final entity in the chain, the amount of the transaction should be entered in field K_11, additionally identifying it in the recordkeeping portion with the designation “TT_D.” And in the declaration portion of the VAT SAF-T (JPK_VAT), the taxpayer should also mark field P_66.

This transaction should also be shown in the EU VAT summary information. This entity will report there the intra-Community acquisition of goods from the first VAT payer (section D of the form) and intra-Community supply of goods to the last entity in the chain (section C of the form), marking for both of these transactions the field in column d, “triangular transactions.”

Third VAT payer in the chain

The third and last VAT payer in the chain is required (under VAT Act Art. 138(1)(2)) to:

- Settle VAT on the intra-Community acquisition of goods on the self-charge basis

- Include in its records, apart from the data set forth in VAT Act Art. 109(3), also the turnover due to the supply made to it, the amount of tax allocable to this supply (field K_23 and field K_24 of the VAT SAF-T (JPK_VAT) with declaration), and the name and address of the second VAT payer in the chain

- Prepare summary information on the intra-Community acquisition of goods.

In the case of the third entity, there is no obligation to make any additional designations.

PIT-2 will be filled out by employees (employment contract, outwork, service contract, social work), by people performing contractual employment (contract of mandate, contract work, etc.), and by employees working multiple jobs.

The new PIT-2 form (9) is called „DECLARATIONS/APPLICATIONS of taxpayer for the purpose of calculating monthly advances on personal income tax” and contains 5 declarations and 3 applications for the taxpayer for the purpose of calculating monthly advances on personal income tax.

5 employee declarations:

- Part C – taxpayer declaration on applying the amount reducing tax, i.e. the tax relief which is submitted to the workplace and to the remitter, such as the principal, ordering party, etc. The amount reducing tax equals PLN 300 monthly, PLN 3,600 annually. The taxpayer will be able to indicate a maximum of three remitters to apply the amount reducing the PIT advance. In each case, this will cause the tax advance to be reduced by:

- 1/24th of the amount reducing tax, i.e. PLN 150, when authorizing two remitters;

- 1/36th of the amount reducing tax, i.e. PLN 100, when authorizing three remitters;

- 1/12th of the amount reducing tax, i.e. PLN 300, in the case of one remitter.

- Part D – taxpayer declaration on applying the amount reducing tax, submitted only to agricultural production cooperatives, and other cooperatives dealing with agricultural production, and the enforcement authority paying workplace receivables from the employment relationship and related relationships, or an entity which is not a legal successor of the workplace which takes over the workplace’s obligations resulting from the employment relationships and related relationships.

- Part E –taxpayer declaration on the intent for preferential taxation of revenue (with a spouse or as a single parent). The taxpayer submits a declaration on the intent for preferential taxation of revenue with a spouse, or as a single parent, when:

- predicted annual revenue will not exceed PLN 120,000, and the spouse or child do not receive any income which is conjunct with the income of the taxpayer - the taxpayer will collect tax advances for all months in a year in the amount of 12% and will apply double tax relief, i.e. 2x PLN 300 per month;

- predicted annual income will exceed PLN 120,000, while the income of the spouse or child, which are conjunct with the taxpayer’s income, will not exceed PLN 120,000 – then the taxpayer will collect tax advances for all months in a year in the amount of 12% and will apply single tax relief, i.e. PLN 300 per month.

- Part F – taxpayer declaration on applying increased employee tax deductible costs (KUP), or on fulfilling the conditions for applying higher KUP – PLN 300. The condition is that the taxpayer's place of permanent or temporary residence is outside of the city in which the workplace is located, and that the taxpayer does not receive expatriation allowance nor reimbursement of workplace travel costs (except when reimbursed costs are treated as taxable income).

- Part G – taxpayer declaration on fulfilling the conditions for applying exemptions and reliefs such as: relief for parents of four or more children, relief for persons returning from abroad, relief for working seniors. In the event of eligibility for multiple reliefs, the sum of revenue exempt from taxation may not exceed PLN 85,528. A taxpayer who has not submitted a declaration to the remitter concerning benefiting from these reliefs does not lose the right to utilize them, as they may be applied during the annual PIT settlement in accordance with rules specified in the act on PIT.

The following tax reliefs for revenue up to PLN 85,528 during the tax year are for:

- parents exercising parental authority over four or more children (this relief applies to each parent separately);

- persons returning from abroad, for four successive years after moving. An exemption from tax is allowed to each taxpayer moving their place of residence to Poland. The exemption for persons returning from abroad will be available during the four successive tax years counting from the beginning of the year in which the taxpayer moved his or her residence, or from the start of the next year;

- working seniors, who despite having reached age 60 (women) or 65 (men) waive receipt of benefits under a retirement pension, family disability pension, or pension for uniformed services or judges in order to continue working, performing contracts, or operating a business. This relief extends only to income that is the basis for social insurance. The exemption for pensioners who are professionally active and not receiving pension benefits is applicable solely to revenue earned as part of an official relationship, employment relationship, cottage industry or cooperative employment relationship, under contracts of mandate referred to in PIT Act Art. 13(8), and in non-agricultural business activity. Revenue earned under a managerial contract or copyright agreement is not eligible for this relief.

3 employee applications:

- Part H – application for:

- not utilizing the relief for young taxpayers – the relief for young taxpayers is an exemption from personal income tax for people who are under 26 years of age for amounts not exceeding PLN 85 528;

- not utilizing employee tax deductible costs (KUP) - KUP in the basic amount of PLN 250 or the higher rate of PLN 300 per month. It is particularly dedicated for employees with multiple jobs who want to avoid a tax surcharge in the annual settlement. This occurs because the annual KUP for employees is limited by an amount which:

- for basic KUP rates equals PLN 3,000 for those working one job, and PLN 4,500 for people working few jobs;

- for higher KUP rates equals PLN 3,600 for those working one job, and PLN 5,400 for people working multiple jobs.

A discontinuation of applying the relief for young taxpayers, or KUP during the year does not deprive the taxpayer from applying these reliefs in the annual PIT settlement, when the conditions specified for these reliefs are met.

- Part I – taxpayer application discontinuing the application of 50% tax deductible costs (KUP) on the account of copyrights, related rights and the disposal of these rights (this concerns employees who are creators, artists, or performers). During the tax year, 50% of KUP may not exceed the amount of PLN 120,000. The discontinuation of applying these costs during the year does not deprive the taxpayer from applying these reliefs in the annual PIT settlement (taking the limit into account), when the conditions specified for this relief are met.

- Part J – taxpayer application on not collecting advance payments during the tax year. This concerns the taxpayer who predicts that their annual income will not exceed the amount of tax allowance – PLN 30,000.

Key questions concerning the new PIT-2 (9) form

When should the PIT-2 be resubmitted in the new version?

According to art. 31a par. 3 and par. 4 on PIT, if the circumstances influencing the calculation of tax advances have undergone change, the taxpayer is obliged to withdraw or change the previously submitted statement or application.

In what form should the previously submitted PIT-2 declaration be withdrawn or changed?

Withdrawing and changing the previously submitted statement or application is made by submitting a new declaration or application. The document is submitted „in writing or in another method accepted by the remitter” as mentioned in art. 31a par. 1 in the PIT Act. The employer may therefore accept PIT-2 through their dedicated HR & payroll software.

Example: If the taxpayer wants to change or withdraw the declaration previously submitted to the employer on applying the amount reducing tax, part C must be filled out. Wherein, in the case of changing the previously submitted declaration, the taxpayer fills out section 6, and, in case of withdrawing the previously submitted calculation, fills out section 7.

Is the PIT-2 declaration valid after terminating employment?

In the new PIT-2 declaration, the Ministry of Finance indicates that after terminating the legal relationship between the parties, when calculating tax advances, the remitter does not apply declarations and applications which were previously submitted by the taxpayer, except for:

- taxpayer applications included in part H – i.e., application on not applying the relief for young taxpayers nor employee tax deductible costs;

- taxpayer applications included in part I – i.e., application on discontinuing the application of 50% tax deductible costs (KUP);

The new PIT-2(9) form may be downloaded on the Ministry of Finance website.

Download the PDF file here.

The most important change is the legislator's indication of how to report aggregated documents. It is a departure from the previous rule, according to which invoices and documents should be recognized according to the date when the tax obligation arose. This was impossible to implement in the case of collective documents where tax obligations of individual transaction arose on different dates.

The amendment to the Regulation of the Minister of Finance, Investments, and Development of October 15, 2019, concerning the detailed scope of data contained in tax returns and records in the scope of tax on goods and services, introduced the solution that transactions recorded on the basis of collective documents should be recognized according to the date of the last event covered by the document.

The content of the amended regulations can be found here.

Currently, companies with a turnover of less than 1.000.000 EUR can apply the tax on income system instead of CIT, hence the companies are paying 3% tax calculated at their taxable income instead of 16% CIT calculated at the accounting profit adjusted with non-taxable revenues and non-allowable expenses. In case the company has one full time employee, instead of 3% tax, it pays 1% tax. The companies applying this reduced taxation system are called micro-enterprises.

Starting with 1st of Jan 2023, the tax on income taxation system will change. A company can be included in the category of micro-enterprise income taxpayers, if it cumulatively meets the following conditions:

- achieved income that did not exceed the equivalent in RON of 500.000 EURO ( the Government still argues, if the threshold is applicable based on the incomes registered in 2022 or it is the reference threshold for companies in 2023) ;

- has at least one full-time employee or management contract/mandate with the minimum gross salary, with the exception of newly established companies (these have a deadline of 30 days from the date of registration of the legal entity);

- has associates/shareholders, who hold more than 25% of the value/number of participation titles or voting rights in no more than three Romanian legal entities that qualify to apply the tax system on the income of micro-enterprises, including the person who verifies the fulfilment of the conditions;

- the company is not in dissolution, followed by liquidation, registered at the Trade Registry or the courts, according to the law;

- achieved revenues, other than those from consulting and/or management, in a proportion of more than 80% of total revenues;

Companies entitled to apply the reduced taxation system will have a single tax rate of 1% from their taxable income. The 3% tax rate will not be applied anymore.

Therefore, even though your company did not exceeded 500.000 EUR or 1.000.000 EUR ( in case the threshold is maintained for 2022 ) as income in 2022, in case there is no one employed full time by the end of 2022, the company will apply 16% CIT starting with 2023. Also, if the activity performed refers to consulting or management in a percentage of more than 20%, the company still cannot apply the micro-enterprise system in 2023, regardless the registered income and number of employees.

The so-called draft directive “VAT in the Digital Age” introduces a variety of amendments to VAT settlement within the EU. The utilization of new technologies will help minimize the VAT gap, counter tax fraud, as well as limit administrative costs for some entities.

The European Commission’s announcements.

The European Commission’s proposals encompass mandatory, real time e-invoicing via continuous transaction controls (CTC) for intra-Community trade. The definition of an e-invoice will also be determined, specifying it’s format and standard while nullifying the PDF invoice.

Important: It must be remembered that KSeF will become mandatory from 2024.

The directive will also enable European Union member states to introduce e-invoicing for domestic transactions without applying for consent from the Council of the European Union.

The package of planned changes also predicts developing upon the existing VAT OSS procedure. Instead of registering for OSS separately in each country, entities will only have to register once for VAT purposes for B2C transactions with all EU member states. Such facilitation with bring enormous savings to SME’s in registration and administration costs.

Other amendments may include defining how internet platforms providing transportation or accommodation services will settle the VAT tax. This will include specifying definitions of internet platforms and their role in transactions. Experts predict that some internet platforms will be treated as regular service providers, with an obligation of deducting VAT from transactions.

The implementation of these changes is planned for 2025-2028.

According to the new regulations, the 0% VAT rate on certain food items (listed in points 1-18 of Appendix 10 to the VAT Law) has been extended to 2023. The 0% VAT rate was also extended until June 30th, 2023 for the free supply of goods and provision of services for the purposes of assisting victims of the effects of warfare on the territory of Ukraine (if the supplies are made to the Government Agency for Strategic Reserves, medical entities, local government units).

The VAT rate on soil conditioners, growth stimulators or cultivation substrates was raised from 0% to 8%.

The Ordinance also restores (subject to the above-mentioned service goods) VAT rates which were reduced on February 1, 2022 (which we wrote about here: Temporary VAT reduction from February 1) in connection with the so-called anti-inflation shield, such as the 23% rate on fuel.

You can read the regulation here.

Carrying the introduced changes over into practice within a company may, in some cases, give rise to many questions. The KR Group VAT team supports clients in such instances.

Download PDF file here.

Since January 4th, 2021, it is obligatory to send all data on invoices to the Tax authority, amending and invalidating invoices subject to rules of the VAT Act. [CXXVII of 2007 on general sales tax. Act (VAT Act) Annex No. 10.]

Data must be provided via the following website - link.

All Hungarian companies undergoing VAT taxation must be familiar with this system.

When and why will two-step authentication come into effect?

The new identification method will come into force on the evening of December 5th, 2022, when the National Tax and Customs Administration (NAV) will be carrying out maintenance on the Online Invoice system.

From this day onward, to guarantee heightened security of electronic administration, secondary users can only access the Online Invoice system using two-step authentication.

When a secondary user logs into the Online Invoice system for the first time, upon entering the username and password, an "Enable two-step authentication" window will appear. This interface will guide the user through four steps enabling two-steps authentication.

Four steps

Step 1: Selection of an identification method

It must be indicated which method of two-step identification should be used. A taxpayer may choose between:

- notification-based identification, and

- code generation.

When choosing a notification-based identification method, the Online Invoice system sends a notification to your mobile phone, which you can click to confirm your login. For this procedure, your mobile phone needs Internet access.

When opting for code generation, the user must input a code generated by the mobile application downloadable via the Online Invoice system website. This method does not require an Internet connection on your mobile phone.

Step 2: Downloading and opening the application

When choosing notification-based identification, it is necessary to download the NAV Identification application to your mobile phone (it is available on app stores). It is free to download and can installed on both iOS and Android devices.

A taxpayer may choose between the NAV Identification application or any other TOTP identification application (such as Google Authenticator).

If the user is already using the Online Billing mobile application, there is no need to download a separate application, as the "Two-step identification" menu item of the Online Billing mobile app provides for such identification.

Step 3: Linking

The installed application must be connected to the Online Invoice system via the web interface. To connect, the QR code generated by the Online Invoice system must be scanned into the application using the phone's camera or, if scanning does not work, a 16-digit code must be entered manually. Pairing only needs to be done when using the application for the first time.

Step 4: Checking

Finally, to enable two-step authentication, the user must enter the verification code displayed in the mobile application into the Online Invoice system website. The "Successful verification" interface displays security keys enabling login for when two-step authentication fails. After this, it is possible to log into the web interface of the Online Invoice system by entering the code generated by the application, or by approving the entry notification (depending on the chosen identification method).

Entering the username and password is mandatory for secondary users during each login on the Online Invoice system interface, the two-step identification method can be changed freely in the user profile.

Important

The deadline for preparing local transfer pricing documentation for all statutorily obligated entities, whose fiscal year coincides with the calendar year, is near - December 31st, 2022. What is more, these entities are obliged to submit the TPR declaration to the Head of KAS and submit a statement on the preparation of transfer pricing documentation, signed by the Company's representatives, to the correlating Tax Office.

Penalties and sanctions for a failure to comply with transfer pricing obligations are quite severe, and fiscal penal liability related to TPR lies within management board members.

The approaching new year is also a time to consider reviewing/annexing contracts. Transactions between related parties on non-market terms may result in additional tax sanctions imposed on the Company.

The Act on Maximum Energy Prices

The so-called Law on Maximum Energy Prices (the "Act") has been in force since November 4th. On the basis of this Act, a template for declarations submitted by authorized entities has already been published.

Micro, small or medium-sized enterprises (“SMEs”) should submit the indicated declaration by November 30th, 2022 in order to take advantage of lower statutory energy prices.

This declaration is voluntary and must be submitted to the energy supplier. It will enable an entity to benefit from a maximum energy price of 785 PLN/MWh until the end of 2023.

Who can expect to pay lower prices?

Definition of an SME according to the Entrepreneurs' Law

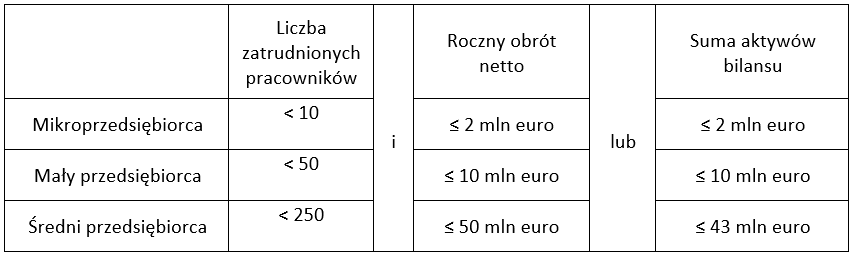

The Act defines an SME, to the extent of which it consumes energy for its core business needs, by referring to the provisions in the Entrepreneurs' Law. The status of an SME is verified in terms of the number of employees and the financial data of the entrepreneur (annual net turnover from the sale of goods, products and services, and financial operations, or the sum assets in its balance sheet). The criteria for defining an SME, according to the Entrepreneurs' Law, are:

The entrepreneur should meet the criteria specified above in at least one of the preceding two fiscal years.

Definition of an SME according to EU legislation

Micro, small and medium-sized enterprises are also defined by EU legislation. Accordingly, the SME category includes companies with less than 250 employees and an annual turnover of less than EUR 50 million, or an annual balance sheet sum of less than EUR 43 million. The limits on employment and financial data are therefore consistent with regulations of the Entrepreneurs' Law. The key difference in defining an SME in EU law relates to the consideration of the examined entrepreneur's connections with other entities.

In the case of a company which is part of a larger capital group, it may be necessary to submit the number of employees and financial data of related entities and consider the limits in context of the sum of these factors.

Important

A small Polish company, which is part of a multinational group, may qualify as an SME in the absence of considering ties with other companies within the group, and at the same time exceed the limits of employment and financial data once those related companies are taken into consideration.

Justification for the aforementioned definition of micro, small and medium-sized enterprises is the conviction that SMEs are primarily differentiated from larger businesses by their limited access to investment funds and higher liquidity risk. Therefore, they require significant protection. In the case of a formally small company, which, however, is backed by companies with a much larger scale of operations, the indicated factors simply do not exist.

Legislator's mistake or intentional action?

Within the meaning of the Act on Maximum Energy Prices, does a small and medium-sized enterprise constitute a different entity from a small and medium-sized enterprise within the meaning of regulations applicable in the European Union, including within the series of instruments implemented by Polish regulations and financed both with Polish and EU funds?

The justification of the Act does not provide guidance in this regard. According to press reports, the Ministry of Climate and Environment indicated that relying in the Act only on the definition from the Entrepreneur's Law was intentional. The Ministry indicates that the energy price aid should not discriminate against any entity due to it being part of a capital group. Does this resolve the dilemma for entrepreneurs affected by this issue?

Inconsistencies of the regulation in question with the system of state aid that has been built for years within the entirety of the European Union may certainly be worrying. Particularly, the introduction of a breach in the definition of SMEs appears to be directly incompatible with Council Regulation (EU) 2022/1854, which allowed for a temporary extension to SMEs of the possibility of public intervention in energy pricing.

On one side, the introduced solution is aimed at protecting a wide range of entrepreneurs and minimizing the effects that may be associated with a drastic increase in the costs of business operations. On the other hand, the uncertainty in which group entrepreneurs find themselves may give rise to business risks. It is necessary to introduce urgent changes in law, or a resolution of the indicated dilemma in a more convincing and legally relevant way than via press reports.

The new obligations should be implemented by the end of 2022 and will take effect on January 1, 2023.

Who will be affected by the new obligations?

The regulation will impose new obligations on digital platform operators who offer goods and services via their platforms. These rules will apply to platforms within the European Union, including Poland, as well as those in third countries.

The formal and reporting obligations introduced by the DAC7 Directive will apply to all software operators - of both websites and mobile applications – who provide their interface to sellers.

Mandatory reporting

Reporting will pertain to:

- rental of real estate, both residential and commercial;

- provision of personal services;

- sale of goods;

- rental of means of transportation.

The data of sellers (users of digital platforms) and the amount of income they have earned, will be reported.

The digital platform operator will be required to collect information about sellers, such as:

Natural person

- name and surname;

- main adress;

- tax identification number;

- date of birth;

- VAT identification number, if available.

Legal person

- company name;

- main adress;

- tax identification number;

- VAT identification number, if available;

- business registry number;

- information on the possible permanent establishment, indicating each EU member state where the permanent establishment is located.

In case of rental property, the digital platform operator will also have to collect additional information about the property, such as: the address of each rental object, along with the registration number of the property in the Land Registry; as well as the number of days each group of rental objects was rented for during the reporting period. In certain situations, it is even expected that documents proving ownership of the property in question must be collected.

Important: The digital platform operator will be obliged to inform sellers about the scope of data provided to the tax authorities.

Due diligence

In addition to reporting obligations, the DAC7 Directive requires reporting platform operators to follow certain due diligence procedures, including verifying information obtained from vendors and determining their tax residency.

A Single Member State Selection Procedure

The information will be reported to tax authorities, which will be obliged to provide this information to the suitable authorities of other European Union Member States.

The reporting digital platform operator will be exempt from the obligation to report vendor information in case it is proven that another reporting platform operator, including one reporting in another member state, will report the same information.

Dates and sanctions

The Ministry of Finance has prepared a draft of assumptions and preliminary regulations that define the reporting deadline and specific sanctions for a failure to comply. According to the current plans, the information should be reported to the competent tax authority no later than January 31st of the year following the calendar year in which the reporting obligation occurred.

If the reporting obligation is not fulfilled, the Ministry of Finance plans to introduce a fine for the platform operator of no more than PLN 5,000,000 and no less than PLN 100,000. As part of the sanction, the reporting platform operator may also be crossed off the register as a VAT taxpayer.

Additional obligations of digital platform operators

The implementation of the DAC7 Directive will entail further obligations. Digital platform operators will also have to:

- make additional registrations in order for them to obtain another number necessary to fulfill this obligation (the so-called individual platform number);

- implement procedures for verifying vendors who are provided with the opportunity to trade through their platform in order to exercise due diligence;

- adjust their IT systems to obtain relevant data required for the proper implementation of the new reporting obligations;

- implement procedures for RODO acquired in connection with the imposed reporting obligations;

- ensure proper business controls over the process of collecting and reporting information, as well as archiving it;

- updating the existing regulations and conditions for the provision of services;

- informing their customers (sellers) about new obligations and the related necessity to introduce changes in the mentioned areas.

The entry into force of the DAC7 Directive leads to a new obligations for digital platform operators, including fulfilling due diligence, as well as reporting obligations. It is not yet clear how they will be implemented into the Polish legal order. Experience with the Mandatory Disclosure Rules (MDR) regulations indicates that we may expect an expansion of obligations relative to the minimum provided by the EU directive.

Download the PDF file here.

One of these concessions is the possibility of an early termination of the rental agreement, which often involves an additional fee charged by the landlord, to be paid by the tenant. In these instances, the decisive role is the landlord’s consent to an early termination of the rental agreement without adherence to the prescribed notice period.

Termination of the rental agreement

By giving such consent, a landlord carries out additional service to the renter, who is subject to VAT. This is a paid service where the compensation represents remuneration for a specific action of the landlord.The condition for the existence of a relationship between the payment of receivables and the receipt of a consideration is met - it is a necessary condition to recognize that the payment of such an amount is subject to VAT.

Expressing consent to the early termination of the rental agreement, through the concluded contractual conditions, or the signing of an appropriate agreement between the parties and payment of a specific amount by the tenant, ends the rental relationship.

VAT and termination of the agreement

According to the VAT laws, the provision of services is understood as any act for the benefit of a natural person, a legal person, or a non-corporate organizational unit, which does not constitute a supply of goods, including an obligation to refrain from an activity or to tolerate an activity or situation (Art. 8(1)(2) of the VAT law).

Therefore, the concept of providing services has a very wide scope. It includes not only specific actions, but also a commitment to refrain from performing an action or situation. Thus, the concept of service is understood as any behavior, which may include an act of doing something, as well as an omission, consisting of not doing something or tolerating something.

Thus, the fee, which is a form of compensation paid by the renter, cannot be treated as compensation for the landlord's lost profits. After all, the landlord does not suffer losses due to non-performance, or improper performance of an obligation. Such fees arise from a legal relationship, such as a rental agreement, and are subject to VAT on the same basis as rental services. Therefore, landlords should document the amount received as they would document a rental service (Judgment of the WSA of 17.10.214, III SA/Wa 1230/14).

Tax rulings

The Director of the National Tax Information, in the issued tax rulings, unequivocally recognizes that in the event of early termination of the agreement by mutual consent of the parties, we are dealing with the provision of a service within the meaning of VAT Act. Consequently, the fee charged constitutes remuneration for the provision of the service and, as such, should be documented by an invoice. Confirmation of the cited thesis should be sought in, among others: tax ruling of October 11, 2022, mark: 0113-KDIPT1-1.4012.508.2022.4.RG, tax ruling of September 23, 2021, sign: 0112-KDIL3.4012.264.2021.1.AW, tax ruling of September 3, 2021, sign: 0111-KDIB3-2.4012.409.2021.4.SR, tax ruling of October 31, 2019, sign: 0114-KDIP1-2.4012.580.2019.1.MC, or in the judgments of the Supreme Administrative Court, among others, of March 22, 2017, ref. no. I FSK 1283/15, in the justification of which the Court indicates, among other things, that " (...) the Court of First Instance correctly held that the payment by the lessee, on the basis of the agreement concluded with the lessor, of the amount specified in this agreement for early termination of the rental agreement, constitutes remuneration in exchange for the provision of services within the meaning of this provision and is therefore subject to VAT. This is the nature of the payment, called "compensation" by the parties to the rental agreement, the administrative courts have previously pointed out. (...) an agreement to earlier termination of the contract in exchange for payment of a certain amount should be evaluated as a commitment to refrain from pursuing from the renter the effects of the lease agreement that united the parties, and such behavior falls within the concept of service within the meaning of Article 8 (1) of the VAT Act (...)."

PUE, or the Electronic Services Platform, made available by the Social Insurance Institution (ZUS) is a website enabling the settlement of various affairs falling into

the scope of social or health insurance, or the payment of contributions.

So far, the requirement of having a profile on PUE ZUS only concerned contribution payers who settled payments for more than 5 people. After the upcoming changes, this obligation will concern all entrepreneurs, including small business owners who hire up

to 5 employees, as well as those who only pay contributions for themselves.

How do you create an account on PUE ZUS?

A contributions payer may create an account for themselves or fully authorize another person, ex. an accountant, or an employee of an accounting office.

Exact instructions on creating an account on the internet platform are available on this website: https://www.zus.pl/-/do-30-grudnia-2022-r.-ka%C5%BCdy-p%C5%82atnik-sk%C5%82adek-powinien-za%C5%82o%C5%BCy%C4%87-profil-na-pue-zus-1?redirect=%2F

We recommend creating these accounts as of today. This can be done through

a personal visit to any Social Insurance Institution (ZUS) office or online via the Trusted Profile account.

The most important changes introduced by the Polish Deal 3.0 include:

- repealing the obligation to document indirect tax haven transactions;

- increasing the documentation thresholds for direct tax haven transactions - according to the amendment, the thresholds will be:

- 2.5 million PLN - for financial transactions,

- 500 thousand PLN - for non-financial transactions.

- clarifying provisions relating to a foreign establishment located in a country that is on the list of so-called tax havens.

Important: It is specified that the documentation thresholds listed above also apply in this case. Transfer pricing documentation must be prepared when these amounts are exceeded.

An important aspect of these changes is the effective date. While the amended provision which applies to establishments will come into force on January 1, 2023, both the repeal of obligations to document indirect tax heaven transactions, and the increase in the thresholds for transactions carried out directly with tax haven, have been retroactively applied and will apply to transactions carried out from January, 1 2023. These changes, especially in the area of indirect tax haven transactions, should be viewed positively.

We have already described what VAT groups are in the article Polish Deal - Introduction of VAT Groups, published on our website.

The form in which the document was issued, i.e., tax explanations referred to in art. 14a § 1 point 2 of the Act of August 29, 1997 Tax Ordinance (Journal of Laws 2021.1540, i.e.) is very significant for taxpayers. A taxpayer's compliance with principles described in the aforementioned explanations issued in the manner provided for the act mentioned above, may not harm the taxpayer.

The VAT group in Polish law

The essence of introducing the VAT group (GV), which is not a new solution within the EU, but has been introduced into Polish law for the first time, is to enable the treatment of several entities as one VAT payer.

The VAT group, in accordance with the amendment to the VAT Act, which will enter into force on January 1, 2023. should be understood as a group of entities related financially, economically, and organizationally, registered as a VAT taxpayer. This construction can therefore be understood as a legal form of cooperation between several separate entities for VAT purposes.

Important: the VAT group is relevant only for VAT purposes and in this respect this form is superior to other legal provisions. In the remaining scope (civil law, commercial law) the entities creating the group still retain their separate character and legal form.

VAT Group - benefits

The main benefits of establishing a VAT group are the simplifications of settlements between related entities. This simplification is reflected in the fact that intra-group transactions are not subject to VAT. This may result in an improvement of financial liquidity. The creation of a VAT group may be of particular importance for industries where one entity providing, for example, VAT-exempt services, uses services of entities providing it with VAT-taxed services. Accordingly, a problem with tax deduction arises. The VAT group can solve this problem (such situations may occur, for example, in the sector of banking, insurance).

What do the tax explanations contain?

The explanations of the Minister of Finance focus on the conditions of establishing a VAT group (GV), the rules of settlements during its operation, as well as issues related to the termination of activities by the group.

The tax explanations include:

- explanations regarding the fulfillment and maintenance of meeting the conditions for relationships within the GV, including the possibility of changes which will not affect the interruption of conditions for the existence of these conditions on a continuous basis;

- simplified procedure for importing goods; only the import of goods carried out by a VAT group member who meets the conditions specified in the regulations may be settled directly in the tax declaration by the VAT group;

- explanation of the subject matter concerning branches of foreign entities, including examples concerning transactions between a branch of a foreign entity that entered GV and the entity's headquarters or a branch from another country;

- an indication that, according to civil law, the written form of the declaration of will is equivalent to the electronic form, and therefore the GV contract may be concluded in both of these forms;

- the subject of the coefficient and pre-coefficient, in a situation where a former group member performed only activities for other members of the VAT group;

- issue of the cessation of the legal existence of GV, the Minister explains that it occurs at the moment of GV de-registration, and not by the loss of continuity of the prerequisites for its establishment;

- a large part of the explanations was also devoted to issues of activities performed in the periods at the junction of the establishment of the GV and its liquidation.

Further doubts

Tax explanations were a long-awaited document, explaining many doubts, but not solving all problems and ambiguities. The issue of the protective power of the previously issued individual interpretations for individual group members has not been satisfactorily clarified, although the regulations indicate that individual interpretations issued for the group before its formation have protective power. However, in the scope relating to the group, it is not known, what kind of power will be bestowed upon individual interpretations issued for individual members of the GV before its creation and to the extent relating to these entities, and not to the group.

Another confusing aspect are the explanations concerning the so-called VAT ratio. Their application may constitute a large administrative burden for entities meeting the conditions for establishing the GV.

The problems that the GV will have to face and the ways to solve them will crystallize out in practice. At the moment, it is still difficult to predict what problems taxpayers may face in this regard. It is certainly not an easy issue, and one should thoroughly prepare for it, analyzing not only the economic benefits and the fulfillment of conditions, but also the burdens and risks.

You can read the explanations of the Minister of Finance here.

A major amendment to the Polish Labour Code is quickly approaching. Work is now underway on several bills, but employers should prepare now for the numerous upcoming changes whose implementation will require appropriate adjustments within their organization, to employment contracts, employee documentation, and internal rules and policies. We encourage you to read the first in a series of articles on Labour Code amendments.

The planned changes involve:

- Remote work and sobriety testing. The parliament is currently working on a bill in this area. The amending act is to enter into force 14 days after publication in the Journal of Laws. In our view, it is highly likely that the regulations on remote work and sobriety testing will enter into force before the end of 2022.

- Employment contracts, employee documentation, parental leave, and release from work. Currently the bill is awaiting approval by the Council of Ministers, and then it will be considered by the parliament. In the bill, the date of entry into force is stated as 1 August 2022, but given the state of advancement of work on the bill, it was not possible to meet that deadline. The new effective date is not yet known, but based on the parliamentary calendar, a possible date for entry into force of this amendment to the Labour Code is 1 January 2023. This amendment is aimed at implementing two EU directives into Polish law: Directive (EU) 2019/1152 on transparent and predictable working conditions in the European Union and Directive (EU) 2019/1158 on work-life balance for parents and carers. These two directives were supposed to be transposed into national law in all EU member states by 1 August 2022 and 2 August 2022, respectively. Despite the lack of national provisions in Poland, EU labour law protects all EU citizens, and employees can seek resolution of disputes before the Court of Justice of the European Union. Thus employers should prepare now for the planned changes: new informational duties, changes to internal rules, and introduction of appropriate solutions and instruments within the organization.

Labour Code amendments: Remote work and sobriety testing

Changes concerning remote work

The regulations on remote work will be included in the Labour Code, replacing the provisions on telework.

A change from stationary work to remote work could be made at the initiative of the employer or the employee. This option will exist both at the time of concluding the employment contract and during the course of employment.

The bill addresses in detail the rules for introduction of remote work at an organization, additional duties and rights of the employer related to remote work, planning and settlement of working time in the case of remote work, and new occupational health and safety obligations of the employer.

However, the most important changes concern costs accompanying the performance of remote work. The employer will be required to provide an employee performing remote work the materials and tools necessary to perform the work, and to cover the costs of electricity and telecommunications services needed to perform remote work.

Changes involving monitoring of employee sobriety

The bill addresses rules for monitoring sobriety at the workplace. To introduce sobriety testing in the workplace, the employer will have to:

- Enact or update work rules to include information concerning:

- The group or groups of employees who may be subject to sobriety testing

- The manner of conducting tests, including the type of equipment, time and frequency of testing

- Appoint persons authorized to conduct testing on behalf of the employer, and prepare authorizations for them to process data

- Update the informational clause.

Sobriety testing:

- Could be conducted by the employer if necessary to ensure the protection of life or health of employees or other persons, or to protect property

- Could be conducted using methods not requiring laboratory testing, via a device with a valid document confirming calibration or gauging of the device

- Would consist of a determination of the presence or absence of alcohol or narcotics in the employee’s organism.

Labour Code amendments concerning employment contracts and leave

Changes concerning employment contracts and employee documentation

The bill calls for changes involving:

- Rules for conclusion of employment contracts, particularly a contract for a trial period

- Rules for terminating employment contracts for a definite period

- Rules governing the contents of employment contracts

- Contents of information on employment conditions provided to newly hired staff

- Guidelines on the time for employee training during working hours and at the employer’s cost

- Rules for prohibition of competition by employees

- Employees’ requests to change their type of work, type of contract, or the fulltime nature of their work.

Changes concerning the work-life balance directive as well as additional days off and parental leave

The Polish government is obligated to implement the EU directive under which employees will gain new entitlements involving:

- Flexible working arrangements for employees who are parents or carers of a child up to age 8. Flexible organization of work is defined as including telework, interrupted or shortened working time, weekend work, adjustable or individual working time, or reduced working time.

- New rules for protection against termination of employment—protection of employees during pregnancy, on maternity, paternity or parental leave, and employees who have requested flexible working arrangements, will be expanded. Not only will the employer not be allowed to terminate or dissolve the employment relationship with persons on such leave, but it will also be prohibited to conduct preparations connected with the intention of dismissing such employees.

- New duration of parental leave, rules for applying for parental leave, use of parental leave by both parents, and use of parental leave in parts. Longer parental leave will be introduced—the combined length of parental leave for both parents will be up to 41 weeks (in the case of the birth of one child) or up to 43 weeks (in the case of a multiple birth), where the second parent would be entitled to 9 weeks of this leave.

- New rules for use of paternity leave—shortening the period when it will be possible for an employee raising a child to take such leave from 24 to 12 months after the birth of the child.

- New types of leave:

- Leave for urgent family matters. An employee will be entitled to be released from work for two days or 16 hours during the calendar year due to force majeure, in urgent family matters due to illness or accident, if the employee’s immediate presence is essential. During such release from work employees will retain the right to half their salary.

- Carer’s leave. An employee will be entitled to the new “carer’s leave” of up to 5 days in the calendar year to provide personal care or support for a member of the family or household requiring significant care or support for serious medical reasons. This leave is unpaid.

You will find a more detailed discussion of the planned changes to the Labour Code in our subsequent articles, which will appear in a few days. More about the changes:

- Labour Code amendments, part 2: Remote work and sobriety testing

- Labour Code amendments, part3: employment contracts and leave

We invite you to follow our publications.

Publicly referred to as the "Sasin Tax," (named after the minister who is a man behind this idea) it aims to partially help fund Polish citizens in the face of rising energy prices. In theory, new tax is the Polish equivalent of the so-called "windfall tax" under discussions at the EU level.

The statements made so far show that the tax will most likely apply to all large enterprises (i.e. entities exceeding EUR 50 million in revenue). The tax itself is to be 50 percent on excess profits made as a result of excess margins. Jacek Sasin, the Minister of State Assets, claims that thanks to the tribute, over PLN 13.5 billion will go to the budget.

Who will pay the new tax?

We do not know yet which companies will be subject to the levy. The announced tax on excess profits at the moment is only a media announcement - not a specific draft of the regulations, hence it is too early for its substantive analysis. The preliminary calculations are that PLN 10 billion will be paid by 5 large state companies: PGNiG, PKN Orlen, JSW, PGE czy KGHM. The remaining PLN 3.5 billion will be paid by banks and large private businesses listed on the Warsaw Stock Exchange.

The proposed new tax raises a lot of controversy. Among other things, it raises questions about the timing of imposing new taxes during the ongoing fiscal year. A draft law on the tax on excess profits has already been submitted. According to information provided in the media, it may be discussed at the next meeting of the Council of Ministers.

On December 31, 2022, the following shall become statute-barred:

- the right to deduct input VAT, which arose in 2018 and 2017 in the case of intra-Community acquisition of goods (ICA) and the reverse charge mechanism (RCh),

- liability due to the excess of output VAT over the input VAT, the payment obligation of which arose in 2017.

If the taxpayer fails to reduce the amount of tax due by the amount of input tax within the time limits specified in art. 86 sec. 10, 10d, 10e and 11, the taxpayer may, in accordance with art. 86 sec. 13 of the VAT Act, reduce the amount of due tax by correcting the tax return for the period in which the right to reduce the output tax arose, but not later than 5 years from the beginning of the year when the right to reduce the amount of tax arose. This provision shows that the input tax from which the right to reduce the output tax arose in 2018, and for ICA and RCh in 2017, may be settled by correcting the relevant declaration and submitting it to the Tax Office by the end of 2022 at the latest.

Pursuant to Article 59 § 1 point 9 in connection with with Article 70 § 1 of the Tax Ordinance, the principle is that the limitation period is five years, counting from the end of the calendar year in which the tax payment deadline expired. This means that any liabilities arising from output tax that expired in 2017 will expire at the end of 2022.

We recommend verifying whether all invoices giving the right to reduce the tax due by the input tax for the above-mentioned periods have been included in the Customer's settlements We would also like to inform you that if you need to submit an application for overpayment, this application must be submitted by the end of the year. Submitting the application in the following year will result in its rejection (Art. 79 of the OP).

Download the PDF file here.

The Polish Parliament passed an amendment to the VAT Act, extending the inflation shield reduced VAT rates on selected products until the end of 2022. We reported more on this topic in the following article.

Lower VAT rates apply to basic food products, electricity and heat, natural gas, certain motor fuels, as well as fertilizers and certain inputs used in agricultural production.